Implemented in 2017, it replaced a multitude of complex taxes like excise duty, service tax, VAT, and more, creating a unified national market.

This blog post provides a clear and concise overview of GST in India, covering its applicability, registration process, and crucial aspects for businesses.

Need for GST:

Framework of GST as introduced in India

Framework of GST as introduced in India

♦ Dual GST:

India's Dual GST model allows both the Central and State governments to levy taxes concurrently on goods and services within a State or Union Territory, encompassing intra-State sales by the Centre and service taxation by the States, including the Union Territory of Jammu and Kashmir.

♦ CGST /SGST/ UTGST/ IGST:

CGST and SGST are levied by the central and state governments, respectively, on intra-state supplies. UTGST is imposed by Union Territories on intra-territorial supplies. IGST is collected by the central government on inter-state transactions and imports, distributed among states and union territories.

♦ Classification of goods and service:

HSN is utilized for classifying goods under GST, referring to chapters in the First Schedule to the Customs Tariff Act, 1975. Meanwhile, a new system classifies services into sections, headings, and groups, with each group containing various Service Codes (Tariff). SAC functions similarly to HSN but is used for classifying services under GST.

♦ Composition Scheme:

Under the GST regime, taxable individuals must pay taxes according to CGST and SGST/UTGST for intra-State transactions, and IGST for inter-State transactions, as outlined by the law. To alleviate the tax burden on small businesses, manufacturers, service providers, suppliers of food articles, traders, etc., making intra-State supplies, a simpler tax payment method known as the composition levy is provided.

♦ Registration:

Every supplier of goods and/or services must obtain registration in the State/UT from where they make taxable supplies if their aggregate turnover exceeds the threshold limit during a financial year.

Different threshold limits are prescribed for various States and Union Territories based on whether the supplier deals exclusively in goods, exclusively in services, or in both goods and services.

States with a threshold limit of ₹10 lakh for suppliers of goods and/or services:

- Manipur

- Mizoram

- Nagaland

- Tripura

- Arunachal Pradesh

- Meghalaya

- Sikkim

- Uttarakhand

- Puducherry

- Jammu and Kashmir

- Assam

- Himachal Pradesh

- Maharashtra

- All other states

- Those making any inter-State taxable supply, with specific thresholds.

- Casual taxable persons making taxable supply, with thresholds and exemptions as specified.

- Persons required to pay tax under reverse charge on inward supplies received, excluding those exclusively engaged in outward supplies.

- Non-resident taxable persons making taxable supply.

- Persons required to deduct tax under section 51.

- Persons making taxable supply on behalf of other taxable persons.

- E-commerce operators required to pay tax on specified services.

- Input Service Distributors.

- Providers of online information and database access or retrieval (OIDAR) services from outside India to a person in India.

- Any other notified persons or classes by the Government.

- Electronic Commerce Operators required to collect tax at source, and suppliers through such operators meeting specified conditions.

♦ Exemption:

In addition to providing relief to small-scale businesses, the law also includes provisions for granting exemptions from tax payments on essential goods and/or services.

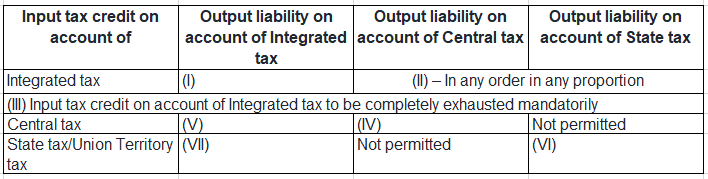

♦ Seamless flow of credit:

In GST, Input Tax Credit (ITC) utilization follows a specific order: first, IGST credit is used for IGST payment, then for CGST and SGST/UTGST; once IGST credit is exhausted, CGST credit is used for CGST and then IGST payment; finally, SGST/UTGST credit can be used for SGST/UTGST and IGST payment, with CGST credit not usable for SGST/UTGST and vice versa.

♦ GST Common Portal:

Resultantly, the common GST Electronic Portal, www.gst.gov.in managed by Goods and Services Network (GSTN), a wholly-owned Government Company, is established to provide a uniform interface for taxpayers and a shared IT infrastructure between the Centre and States.

Accessible over the Internet for taxpayers and their CAs/Tax Advocates, as well as through Intranet for Tax Officials, the portal serves as a single platform for all GST-related service

Does GST apply to all Businesses and Services ?

Does GST apply to all Businesses and Services ?

Exceptions to GST applicability include:

- Alcoholic liquor for human consumption.

- Petroleum crude, diesel, petrol , ATF and natural gas.

- Tobacco is subject to GST as well as central excise duty.

- Opium, Indian hemp and other narcotic drugs and narcotics are subject to GST as well as State excise duties.

Conclusion

Conclusion

GST is a significant step towards a more efficient and transparent indirect tax system in India.Understanding its applicability, registration process, and benefits is crucial for businesses to navigate the new tax regime effectively.

If you have any further questions or require assistance with GST registration or compliance , click on the link below schedule a consultation with us.